Here'a a snapshot of our brand journey with Hang Ten from Day 1 to now. We've come a long way, from the preliminary brand audit to conducting in-depth qualitative and quantitative market research to investigate the tactical and strategic gaps of Hang Ten. Then we put our creative heads together and came up with a marketing campaign that address the brand challenges. After which, we put on our financial caps to derive brand valuation. Lastly, we went a step further to analyze the different growth strategies that could be a great competitive advantage for Hang Ten in the years to come.

It's been a wonderful brand journey, and we hope you're as psyched as we are for our final presentation. Enjoy :)

Assignment 6: Introduction and Core Competencies of Hang Ten

In our final Hang Ten brand assignment, we explore the potential growth strategies of Hang Ten which they can choose to adopt in the future. We define the future in our context as 5 years on after the implementation of our recommended marketing plan in Assignment 4.

In order to better examine potential growth strategies of Hang Ten, it is important to set our foundation proper and determine Hang Ten’s core competencies which can be leveraged on.

Core competencies are strengths and selling points which are unique to a particular brand and help to provide added value to consumers.

We identified the following core competencies:

We identified the following core competencies:

1) Value-for-money

Armed with a cost efficient production and supply chain system, Hang Ten is able to be one of the most price competitive casual apparel retailers in the industry and offers great value-for-money for their consumers.

2) Widely available and accessible

Hang Ten has a whopping 750 stores worldwide which provides themselves with an expansive network of company-owned stores to boost direct distribution to their consumers all over the world. They have the capability to reach out to a wide array of markets and consumers and this could be a valuable arsenal which could be leveraged upon.

3) Understanding of Asian pop culture & values

a. Performing well in Korean and Hong Kong market

Hang Ten has a strong presence in Asia and this region is also the most successful and profitable region in Hang Ten’s portfolio. Hang Ten is doing especially well in Korea and Hong Kong where trendy collections, popular celebrity endorsements, well-designed company-owned outlets along with generous investments in media collaterals have successfully promoted Hang Ten amongst its target segment, boosting a positive brand image amongst youths.

b. Designers are based in Korea and Hong Kong

Most of Hang Ten’s product designers are based in Korea and Hong Kong, which are considered the up-and-coming fashion capitals amongst youths. Korean culture and fashion is also increasingly popular in Singapore, hence, if Hang Ten is able to leverage on their existing knowledge of fashion trends in Korea and Hong Kong and apply this knowledge to redesign the product range in Singapore, Hang Ten might be able to enhance consumers’ perceptions of the brand.

With a better idea of Hang Ten’s core competencies, we can use this as a starting ground to help us better brainstorm and structure the potential growth strategies for Hang Ten in our next few entries.

Labels:

Assignment 6

Exploring Possible Growth Strategies

Moving forward, Hang Ten needs to focus on strategies for future growth and sustainability. We first consider sources of growth for Hang Ten in either current or new markets and/or products before showing our recommendations.

1) Capitalizing on the Hang Ten parent brand for future brand extensions

Brand extension occurs when a firm uses an established brand name to introduce a new product, including line and category extension.

Line extension applies the parent brand, Hang Ten, to a new product that targets a new market segment within a product category the parent brand currently serves

- Casual surfwear for teenage market

- Apparel for kids

- Smart casual and formal for the trendy, working crowd

Category extension applies the parent brand, Hang Ten, to enter a different product category from the one it currently serves

- Intimate wear for men and women

- Shoes, bags & accessories for young, trendy fashionistas

The advantages of brand extensions

Brand extensions are crucial for Hang Ten’s future. It facilitates new product introduction and acceptance from consumers. For example, if Hang Ten were to enter the intimate wear market under the established parent brand name, customers are more likely to accept it and perceived risk is reduced. It also increases efficiency and reduces costs of marketing programmes since consumers are already familiar with the brand name.

In addition, brand extensions can also provide positive feedback to the parent brand by broadening brand meaning and salience. For example, if Hang Ten ventured into the shoes, bags and accessories market, the brand meaning could widen from “casual, comfortable apparel” to “for all casual occasion needs”. This in turn attracts new customers and increases market coverage. If executed effectively, brand extensions can also revitalize and renew interest the parent brand.

2) Expanding the Group through strategic acquisitions

Acquiring new businesses entails the purchase of shares or assets of a corporation by Hang Ten Group.

Hang Ten could acquire either related businesses in the apparel industry or a completely unrelated business for greater business diversification. For example, the Group could acquire close competitor Bossini to drive down competition, achieve synergies in their operations or tap on developed distribution channels to increase market share. Alternatively, the Group could acquire successful restaurant chain, Thai Express, to snap a stake of the highly lucrative F&B industry.

The advantages of acquisitions

Strategic acquisition significantly reduces costs of entering the market and provides fast access to existing resources and expertise. However, before this is done, besides analyzing whether the acquisition is in line with the Group’s strategic direction, the financing options, asset valuation and effects on management and culture must also be considered to outweigh the costs and benefits.

Acquisitions is not recommended

Given the Group’s strategic imperative in establishing itself in the apparel industry, it is unlikely that management will perform dissimilar acquisitions as this deviates from its long-term vision. Acquiring current competitors might prove to be too costly and cumbersome as Hang Ten’s competitors are relatively large.

3) Riding on Hang Ten’s current regionalization to reap the benefits of internationalization

Hang Ten Singapore is under the direction of the Group headquartered in Hong Kong, making it a regional brand with strong presence in South Korea and Taiwan. Due to Hang Ten’s unique licensing structure, the Group manages Hang Ten in South East Asia, while Hang Ten USA is a separate entity.

Internationalization strategy is not recommended

Although it is not within our team’s capacity to recommend an internationalization strategy for Hang Ten Singapore or the Group, we recognize the advantages of developing global marketing programmes that contribute to economies of scale in production and distribution, reduced marketing costs and building a consistent, reliable and recognizable international brand image that reconciles all levels of the CBBE to achieve strong brand resonance. Thus, we will inject the concept of a global marketing programme to our growth recommendations so that Hang Ten can capture the benefits of a unified, regional branding.

Now that we have rejected options 2 and 3, the next entry examines different types of brand extension strategies we can adopt.E

Labels:

Assignment 6

Evaluation of Options

Having learnt about the possible growth strategies of Hang Ten, we now move on to evaluate and assess its attractiveness in serving the options.

According to Ansoff’s Growth Share Matrix, we see the four options that Hang Ten could consider in developing its future growth strategies.

Rejected Options

In line with Hang Ten Holding’s current growth strategy, it is unlikely for Hang Ten to expand into other markets as there are still much potential in the current markets that is not being reaped. Also, although existing products can future penetrate existing customer markets are push into additional ones, new product introductions are often vital to the long-run success of a firm

It is unlikely for Hang Ten to delve into market development, because the parent company already has other brands under its belt that caters to them- for example, Arnold Palmer (under the same parent company) is a brand that targets older men. We will not want to risk conflict of interests with brands under the same parent company.

Therefore, we can rule out the possibility of market penetration or market development in the next 5 years.

Possible Options

In product development, the line extension options of launching kids apparel and targeting fashionable young people with the smart casual and formal wear will allow Hang Ten to leverage on existing knowledge of its counterparts in other countries such as Hang Ten Korea, where the product line is known for being more trendy.

Diversifications into a new market with new product- category extensions such as launching more products under the brand name- such as developing a new accessories line that will complement the current product range offerings. Other options of line extension include delving into surf wear and intimate clothing. However, we feel that these options might not be feasible because there might not be a demand from Hang Ten’s current target consumers for the line extensions.

Evaluation

Some of the advantages that Hang Ten can reap from the brand extensions are improving its brand image, provide consumers with more variety, and avoid cost of developing a new brand, as well as increase efficiency of promotional expenditure, where the company will only need to focus its promotional activities on promoting the new product.

Hence, we are looking into formulating growth strategies with brand extensions, targeting existing markets and new markets. Look out for the next entry, where we will elaborate more on the selected plans!

Labels:

Assignment 6

Product Development

The first strategy we see Hang Ten executing in the next 5 years will be introducing new products but aimed at the current market. We suggest doing so by expanding their current product line to include accessories and other clothing-related items relevant to the target segment. This will make Hang Ten a lifestyle brand as opposed to an affordable casual clothing company.

Product Line Expansion

The types of products that we see Hang Ten adding to their line of offerings include bags, rings necklaces. These accessories should be introduced seasonally with each season carrying a different theme. Below are a few themes we propose Hang Ten use.

The Beach Bum

Hang Ten should start a beach themed collection. This theme is likely to be well-received in Singapore as we are an island with a number of beaches that youths and young adults like to frequent. Thus, riding on the beach-trend wave (pun intended) will help Hang Ten target this segment of the chic beach-goer. This will also be a wise move for Hang Ten as it is consistent with their image in the US and they already have clothing and accessories in this theme. It will thus be easier for Hang Ten to get access to the products and collections in this line. The specific types of items featured in the "beach bum" series includes limited edition Hang Ten board shorts, bikinis and accessories using shell, straw and pearls.

Funky Town

Hang Ten could also introduce an accessory line using psychedelic colours. Psychedelic colours have a cool, youthful and vibrant vibe that could attract youthful fashionistas who are not afraid to wear bold accessories and loud colours. This line could help Hang Ten draw in the segment they are targeting and differentiate them from competitors, Giordano & Bossini, who have yet to expand into such offerings, hence providing Hang Ten a strong first-mover advantage and uniqueness.

Labels:

Assignment 6

Diversification into Korean Style

Within the next 5 years, Hang Ten can consider bringing the H&T sub-brand they currently have in Korea to Singapore as their second growth strategy following the previous implementation of their product extensions. Considering the fact that Hang Ten’s core competency is based on an understanding of “the Asian style”, we believe that introducing H&T to the Singapore market can help Hang Ten capture a broader market and consequently, increase its revenue. Moreover, Hang Ten can also leverage on their existing facilities and capabilities since they can import these new products from Korea without the need of additional manufacturing facilities.

Mode of Entry

The introduction of H&T as a sub-brand is chosen to reduce the transference of Hang Ten’s currently unfavorable brand image to H&T while allowing Hang Ten to partially gain from H&T’s trendier image and popularity among Korean (and, potentially, local) youths.

In entering the Singapore market, H&T should come in force by opening a concept store in a prominent location to signal that it is not simply another fashion label. Given the perceived similarity between its brand and H&M’s, it is even more important that H&T establishes itself strongly during its initial entry to avoid being perceived as a knock-off of the renowned fashion chain. Its launch can be timed to coincide with the performance of a popular Korean artist in Singapore, or even feature a fan-meet by the artistes themselves.

While this is expected to incur sizeable costs, Hang Ten Group Holding’s recently-doubled operating profits are undoubtedly able to cover this. Considering higher potential returns from a new market penetration as compared to further expanding Singapore’s faltering Hang Ten brand, this may in fact be a more prudent alternative.

H&T brand analysis

Target Market : Fashionable, young (18-25 years old) individuals that are knowledgeable and involved in popular culture. They also tend to be less price conscious and value style.

Price: The price point for H&T will be slightly higher than Hang Ten’s current products to impart an upscale image and convey higher product quality; both in material and design.

Product: H&T currently offers Korean fashionable products, relatable to the current fad about K-pop and Korean dramas. In place of Hang Ten’s emphasis on basic casual apparel, H&T focuses more on smart casual clothes consumers often wear to hang-out and for nights out.

Being more trend-oriented and fashionable, H&T’s offerings will not cannibalise on Hang Ten’s products, but rather supplement them in other usage situations and purchase considerations, widening brand salience. A wider range of products is also offered by H&T, including accessories, footwear, knits and jeans.

Place: Rather than expanding into heartland malls like Hang Ten did, H&T retail stores will be opened in higher-end malls (e.g. ION Orchard, Somerset 313, VivoCity, Citylink etc.). H&T products will also be made available for online-shopping on a new, dedicated H&T Singapore website.

Promotion: As in Korea, H&T will rely heavily on celebrity endorsement. Korean celebrities, for one, are highly popular in Singapore, and many often hold music performances here. Idolised girl-band SNSD, singers Jay Park, se7en, Kim Hyunjoong (also currently a H&T brand-ambassador) and actor Jang Geun Suk have all recently made tours to Singapore.

To further reinforce the link between H&T and stylish Korean popular fashion, H&T can sponsor the performances of artists who endorsed H&T products, or K-pop artists in general (e.g. through K-Pop Asia, a dedicated community for K-Pop Korean pop-culture appreciation). Advertisements in fashion magazines and outdoor media around shopping and lifestyle hotspots such as Orchard Road and Clarke Quay are also viable to further increase visibility.

Challenges to growth

Competitors:

By placing its products in the smart-casual segment with higher prices, H&T comes face-to-face with renowned fashion retailers such as H&M, Forever21 and Topshop, all of which have a strong presence and regional flagship stores in Singapore.

While competition is predicted to be stiff, H&T has an edge over its Western-oriented competitors by offering Korean-style products which none of them carry. This “Asian style” advantage, combined with the current hype about all things Korean, can strongly support H&T’s initial market penetration.

Reliance on fads:

Despite its current popularity, the Korean fad may overtime decline, just as previous hypes about Taiwanese and Japanese dramas have come and gone. Lasting an average of not more than 5 years, the eventual decline in the popularity of Korean pop-culture and fashion can and will adversely impact H&T’s performance if it fails to capture a sizeable market within this period or keep up-to-date with upcoming fashion trends.

While the former can be addressed by its time and mode of entry and subsequent marketing program, the latter requires H&T to offer more than just celebrity endorsements. To retain customers once the Korean fad has fizzled out, therefore, H&T needs to simultaneously emphasize its product’s quality while continuously updating and expanding its collection to include styles popular in the region (esp. those of major fashion-hubs such as Taiwan, Japan and Hong Kong), as opposed to those popular only in Korea.

Labels:

Assignment 6

Introduction to Assignment 5

Assignment 5 aims to identify the economic value of the Hang Ten brand to the business by measuring the extent to which the brand helps to drive sales in the respective market segments.

To gain a complete understanding of the brand's value, we employed a 5-stage valuation process. These are:

Stage 1: Identify Hang Ten Singapore's consumer segments based on current sales contribution.

Stage 2: Estimate each segment's expected growth in the near future based on the proposed changes in Hang Ten's marketing program, described in Assignment 4.

Stage 3: Determine how much each segment's purchase decisions are affected by brand-name (as compared to other factors such as price) using the RBI (role-of-branding index) measure.

Stage 4: Evaluate Hang Ten's brand strength through the Brand Strength Analysis to calculate the discount rate on the Hang Ten brand.

Stage 5: Based on each segment's size, expected growth, RBI and Hang Ten's discount rate, we finally calculate future brand earnings per consumer segment, which gives us Hang Ten's current brand value.

Follow the links above to find out Hang Ten's current brand value!

Labels:

Assignment 5

Stage 1: NOPAT & % of Sales by Segment

In stage 1 of the brand valuation process, there are two key pieces of information that we derived, the Net Operating Profits After Taxes (NOPAT) and the percentage of sales by segment. These numbers form the basis of calculating Hang Ten's financial value.

NOPAT

Hang Ten's NOPAT was taken from Hang Ten Group Holdings Limited Annual Report 2011 at SGD 2 276 820 (HKD 12.6 million).

% of Sales by Segment

Four key segments were identified as seen in the table. Identifying these segments were a result of both the quantitative and observatory research conducted by our team over the course of the past few assignments. From this research we uncovered the interests and motivations of these different groups as well as their buying pattern in-store. Subsequently, we extrapolated these consumption patterns into % of sales estimation.

Price-conscious individuals: This group formed the highest sales segment. Based on observatory research they were the group most seen in Hang Ten stores and this was no surprise as their motivations match Hang Tens promotion strategy.

Working adults who value simplicity and comfort: The second highest sales segment was identified based on their appearance and demeanor. They often gravitated to a more expensive collection than the first segment which indicated their higher spending power.

Youths looking for casual apparel: The youth segment is one of the smallest seen in store. Past research as indicated Hang Ten is not a strong brand for them and purchase intentions is dismal.

Events-specific purchases: While the events-specific segment may be smallest in absolute terms, this was due to the minimal number of events supported by Hang Ten. The main event was National Day and Hang Ten experienced note-worthy sales as respondents preferred Hang Ten's simple designs over competitors Giordano and Bossini.

Working adults who value simplicity and comfort: The second highest sales segment was identified based on their appearance and demeanor. They often gravitated to a more expensive collection than the first segment which indicated their higher spending power.

Youths looking for casual apparel: The youth segment is one of the smallest seen in store. Past research as indicated Hang Ten is not a strong brand for them and purchase intentions is dismal.

Events-specific purchases: While the events-specific segment may be smallest in absolute terms, this was due to the minimal number of events supported by Hang Ten. The main event was National Day and Hang Ten experienced note-worthy sales as respondents preferred Hang Ten's simple designs over competitors Giordano and Bossini.

Labels:

Assignment 5

Stage 2: Financial Analysis

Armed with segmentation percentage of sales, we next assess the levels of growth of the different segments after initiating the new and revamped branding and marketing campaign.

Youth & Working Adults segments expected to lead growth

The segments expected to grow the most over the next five years are the youth and working adults segments at 10% and 6% respectively. This is mainly due to the targeted marketing campaign that will change perceptions of Hang Ten as a young, trendy and casual brand for them. The integrated marketing communications will seek to appeal to these segments and thus, improve growth.

Price-conscious & Events-specific segments forecast to grow marginally

On the other hand, the segments expected to grow the least are the price-conscious and events-specific segments at 4% and 2% respectively. As there will be less aggressive marketing pull for the price-conscious individual, we expect growth to slow. We also factor in the possibility of Hang Ten losing some of the segment due to a misalignment between price-conscious expectations and Hang Ten's new image. However, we must also consider the projected organic growth with Singapore's aging population and influx of foreign workers that will still push the segment to experience marginal increase. Event-specific segment is also projected to grow marginally as a result of organic growth in Singapore's population over the next five years.

Hence, using % of sales per segment and respective growth rates, projected sales at the end of the 5th year are estimated at $1.4 million for price-conscious, $800,000 for working adults, $550,000 for youth and $250,000 for events-specific segment.

Labels:

Assignment 5

Stage 3: Role of Branding Index (RBI)

In this step, we are examining the role Hang Ten plays as a brand in driving demand for its products in the market. The figures that we attribute to the RBI of the 4 segments are an indication of the proportion of intangible earnings attributable to the brand.

For example, the RBI for Youths looking for casual apparel is 40%, which means that if in 2010, Hang Ten had $1 million from the youth segment, $400,000 of the earnings can be said to be “earned by the brand”.

Segments | RBI (%) |

A) Price-conscious individuals ("Aunties", "uncles", foreign workers) | 10 |

B) Working adults who value simplicity and comfort | 20 |

C) Youths looking for casual apparel | 40 |

D) Events-specific purchases (e.g. National Day) | 15 |

In determining the figures for RBI, we conducted secondary research, and re-looked at the qualitative and quantitative studies done previously. The main results of the studies are as follows. It must be noted that the value of RBI for Hang Ten is relatively low because this is a brand that

Segment A: Price-conscious individuals are not as concerned about the brand as about the price of the products. Therefore, we can expect high price elasticity of demand, but that is not the case for brand.

Segment B: Similarly, for working adults, the brand does not matter to them as much as the comfort of the apparel. There is a distinction between Segment A because we expect the latter to be more stringent about prices.

Segment C: We believe branding will have the most impact on youths because they value emotional and social qualities the most and this touches the highest stage of CBBE. If a brand is able to make the wearer feel good, popular and induce positive judgment and feelings, the RBI of the brand will be very high. Currently, Hang Ten is not beyond salience yet, hence our rebranding efforts that aim to build brand equity.

Segment D: Events-specific purchases are usually sporadic, therefore, we do not attribute a high score as the absolute amount of sales are relatively low.

Labels:

Assignment 5

Stage 4: Brand Strength

Next, we implement a Brand Strength Analysis to determine the brand risk and discount rate attached to our brand. This provides us greater insights regarding the net present worth of Hang Ten.

There are 7 elements which we need to explore and evaluate to obtain a final value tagged to the brand strength of Hang Ten:

1) Leadership

The ability of Hang Ten to obtain market share and function as a market leader amongst the casual apparel industry. This is lowly rated at 3 because Hang Ten is not a market leader. It is a highly competitive industry with main competitor, Giordano, leading the segment.

2) Stability

Hang Ten's ability to hold on to customer loyalty and retain its brand image amongst consumers over a long period of time. Considering that breadth of brand awareness and its "value-for-money" proposition is relatively strong in the price-conscious consumers' minds, Hang Ten performs relatively well in this respect scoring 6.

3) Market

This measures if the casual apparel market Hang Ten competes in is stable and growing with ample opportunities and high entry barriers to ward off competitors. We rate this lower at 3 because the casual apparel market is saturated with many players competing for share

4) International Image

The extent to which Hang Ten has an international image, which would help boost its status as a strong and quality brand, through a wide presence in foreign markets and active exporting. Given that Hang Ten is headquartered in Hong Kong with ASEAN presence, Hang Ten's internationality is not in question. However, the Singapore market does not seem to believe its international image, hence, the lackluster brand image and performance. With these considerations, we scored Hang Ten a 5.

5) Trend

Hang Ten's ability to remain relevant and up to date with consumers' tastes and preferences. Currently, Hang Ten has much to improve on trendiness and relevance. A conservative estimate puts Hang Ten at 3 in this respect.

6) Support

The extent to which the Hang Ten brand receives organisational support through investment and advertising to help build and sustain the brand. Unfortunately in Singapore, the Group does not provide much resources and focuses instead on its bigger South Korean, Taiwan, Hong Kong markets. Resource leverage is low and so support is rated 3.

7) Protection

The strength of Hang Ten's legal protection of its trademark. Hang Ten scores high on this with 8 because its brand elements are controlled by Hang Ten Group Limited in Hong Kong and has a robust legal protection system.

As we can see, Hang Ten's current brand strength is poor and has a lot of room for improvement. This in turn results in a high discount rate which means that there is a high opportunity cost of capital in investing in Hang Ten.

There are 7 elements which we need to explore and evaluate to obtain a final value tagged to the brand strength of Hang Ten:

1) Leadership

The ability of Hang Ten to obtain market share and function as a market leader amongst the casual apparel industry. This is lowly rated at 3 because Hang Ten is not a market leader. It is a highly competitive industry with main competitor, Giordano, leading the segment.

2) Stability

Hang Ten's ability to hold on to customer loyalty and retain its brand image amongst consumers over a long period of time. Considering that breadth of brand awareness and its "value-for-money" proposition is relatively strong in the price-conscious consumers' minds, Hang Ten performs relatively well in this respect scoring 6.

3) Market

This measures if the casual apparel market Hang Ten competes in is stable and growing with ample opportunities and high entry barriers to ward off competitors. We rate this lower at 3 because the casual apparel market is saturated with many players competing for share

4) International Image

The extent to which Hang Ten has an international image, which would help boost its status as a strong and quality brand, through a wide presence in foreign markets and active exporting. Given that Hang Ten is headquartered in Hong Kong with ASEAN presence, Hang Ten's internationality is not in question. However, the Singapore market does not seem to believe its international image, hence, the lackluster brand image and performance. With these considerations, we scored Hang Ten a 5.

5) Trend

Hang Ten's ability to remain relevant and up to date with consumers' tastes and preferences. Currently, Hang Ten has much to improve on trendiness and relevance. A conservative estimate puts Hang Ten at 3 in this respect.

6) Support

The extent to which the Hang Ten brand receives organisational support through investment and advertising to help build and sustain the brand. Unfortunately in Singapore, the Group does not provide much resources and focuses instead on its bigger South Korean, Taiwan, Hong Kong markets. Resource leverage is low and so support is rated 3.

7) Protection

The strength of Hang Ten's legal protection of its trademark. Hang Ten scores high on this with 8 because its brand elements are controlled by Hang Ten Group Limited in Hong Kong and has a robust legal protection system.

As we can see, Hang Ten's current brand strength is poor and has a lot of room for improvement. This in turn results in a high discount rate which means that there is a high opportunity cost of capital in investing in Hang Ten.

Labels:

Assignment 5

Stage 5: Hang Ten Singapore Brand Value

In the last stage we use the future brand earnings, calculated from % of future sales per segment and RBI, to derive net present value of future earnings and discount the earnings with discount rate found from brand strength. The resulting figure gives the final estimate of Hang Ten Singapore's brand value.

Conclusion

Through the brand valuation process we realize that although it is essential to financially analyze the brand and its contribution to the business, it is equally vital not to merely slap digits on brands and conclude whether it is a failure or not based on absolute numbers. A comparison between initial and future valuation of the brand or that of competitors' could be a good indicator of the brand's real position. Ultimately, the branding process is a long-term relationship building with consumers and therefore it remains a challenge to standardize valuation. After all, it is every marketers dream to hear a consumer say, I love this brand! which might or might not be translated wholly into brand valuation.

Brand value is relatively low, mainly due to the belief that Hang Ten, as a brand, has not yet fully reached its potential to influence consumers. This shows us that there are plenty of areas to improve on, for example, Hang Ten's international image, trend and support from the Group.

Conclusion

Through the brand valuation process we realize that although it is essential to financially analyze the brand and its contribution to the business, it is equally vital not to merely slap digits on brands and conclude whether it is a failure or not based on absolute numbers. A comparison between initial and future valuation of the brand or that of competitors' could be a good indicator of the brand's real position. Ultimately, the branding process is a long-term relationship building with consumers and therefore it remains a challenge to standardize valuation. After all, it is every marketers dream to hear a consumer say, I love this brand! which might or might not be translated wholly into brand valuation.

With the brand valuation, we are coming close to the end of our branding journey project with Hang Ten. Keep your mouse on this page all you Hang Ten-lovers!!

Labels:

Assignment 5

Introduction to Assignment 4

The main aim of Assignment 4 is to address the tactical and strategic gap identified in Assignment 3 by choosing and developing one of our three proposed solutions. The assignment will identify and rationalize the chosen solution by examining it in greater depths and developing it into a marketing campaign that will both address and reconcile the gaps identified.

The overview outlines the thought process that we took in evaluating Hang Ten's current marketing programme in conjunction with our proposed marketing campaign.

Overview

(1) Rationale of chosen solution

(2) Analysis of current Hang Ten brand elements

(3) Exploration of Integrated Marketing Programmes

(4) Elaboration and Evaluation of Suggested marketing programmes

Enjoy!

The overview outlines the thought process that we took in evaluating Hang Ten's current marketing programme in conjunction with our proposed marketing campaign.

Overview

(1) Rationale of chosen solution

(2) Analysis of current Hang Ten brand elements

(3) Exploration of Integrated Marketing Programmes

(4) Elaboration and Evaluation of Suggested marketing programmes

Enjoy!

Labels:

Assignment 4

Our Solution

From our qualitative and quantitative studies, we discovered an evident disconnect between brand positioning and brand image. In order to bridge the gap between the two, we have decided to adopt the strategy:

Retaining Positioning and Identity,

but Altering Marketing Mix

but Altering Marketing Mix

Rationale

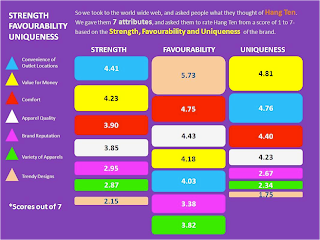

We expect to garner highest returns from this solution. Based on previous research, we concluded that Hang Ten’s consumers rank trendiness as the top factor in the favorability study, but trendiness was ranked last in terms of its role as a contributing factor to the strength and uniqueness of the brand.

Thus, with our strategy to promote Hang Ten as a trendy and youthful brand, we aim to improve its image and standing in the minds of consumers, and have it translated to heightened brand awareness and better sales.

We will be able to leverage on existing knowledge, to learn from competitors who are performing better in terms of their channel, product and communications strategies.

Risks Involved

Risks Involved

Of course, implementation failure could occur when the customers are not receptive towards the brand revamp. This happens most often when a company undergoes a brand revamp, abandoning the loyal customers who are skeptical about the change. As such, Hang Ten will need to proceed with caution to not alienate these customers.

Feasibility of Strategy

However, this strategy is still the most feasible, because of the following four reasons:

1. Hang Ten would be able to capitalize past strengths, while improving the current marketing mix to strength brand equity.2. Minimum cost will be incurred in implementing this strategy, because it requires the least overhaul.

3. As examined previously, the strategy involves the least risk, as it does not lead to a misalignment of internal company goals and drastic changes to the brand positioning and identity.

4. We will be able to avoid any external conflict of interests of operational or copyright issues with the Hang Ten USA counterpart.

With this rationale in mind, the following entries will delve into our team's recommendations and marketing plans for revitalizing Hang Ten.

Labels:

Assignment 4

Brand Elements Decisions

Brand elements are the trademarkable devices that serve to identify and differentiate the brand. Since positioning and identity remains unchanged, the main brand elements of Hang Ten will not be altered to maintain a consistent brand story. We evaluate the overall memorability, meaningfulness, likability, transferability, adaptability and protectabilitty of Hang Ten's brand elements below.

1. "Hang Ten" brand name & logo

3. URL website: http://www.hangten.com.sg

The existing link is clear in defining the brand name and region. It is also protectable and meaningful. Possible Internet naming will follow such convention to ensure consistency and quick identifiability.

1. "Hang Ten" brand name & logo

As suggested from previous research, Hang Ten's breadth of awareness is evident. Consumers can recognize the brand easily with its memorable, iconic two-feet logo. It is the same brand name and logo the Group uses, making these elements protectable and transferable. Hence, we recommend brand name and logo remain unchanged to leverage these strengths.

2. Slogan: "We're Hang Ten"

The current slogan is transferable as all regional Hang Ten stores in Asia employ it. The slogan plays off the brand name to create awareness and reinforce it in consumers' minds. Although it does not summarize the descriptive information of product offerings, it suggests inclusiveness and a sense of belonging. Coupled with our proposed marketing strategy, we will construct a friendly and approachable association in line with its image, making the slogan more meaningful.3. URL website: http://www.hangten.com.sg

The existing link is clear in defining the brand name and region. It is also protectable and meaningful. Possible Internet naming will follow such convention to ensure consistency and quick identifiability.

Labels:

Assignment 4

Exploring the different marketing programs

1. Price

Price is the revenue-generating element of the marketing mix and price premiums are the most important brand equity benefits of building a strong brand. Prices can play multiple roles to the consumer, such as signaling value or quality and competitive pricing. There are two main pricing strategies:

Value pricing aims to strike a right balance of product quality, product costs and product prices that fully satisfies the needs and wants of consumers and firm’s profit targets. Despite increasing competitive pressure on cheaper prices, a strong brand can still command price premiums if consumers value perceptions remain high.

In addressing the strategic gap, we will not alter Hang Ten’s current pricing strategy. In line with Hang Ten’s emphasis on “value for money” prices are kept low. Value pricing contributes to the consistent demand for Hang Ten’s products and remains affordable for its target market and retains Hang Ten’s competitive. It is the communication of pricing that will be adjusted to shift from “discount”-image to “value”-image to build Hang Ten’s brand equity.

Hang Ten can consider Social Media as a new addition to the integrated communications mix with a choice of several outlets such as Twitter, Facebook, YouTube, Blogs and mobile phones applications.

Hang Ten can consider Social Media as a new addition to the integrated communications mix with a choice of several outlets such as Twitter, Facebook, YouTube, Blogs and mobile phones applications.

Price is the revenue-generating element of the marketing mix and price premiums are the most important brand equity benefits of building a strong brand. Prices can play multiple roles to the consumer, such as signaling value or quality and competitive pricing. There are two main pricing strategies:

Value pricing aims to strike a right balance of product quality, product costs and product prices that fully satisfies the needs and wants of consumers and firm’s profit targets. Despite increasing competitive pressure on cheaper prices, a strong brand can still command price premiums if consumers value perceptions remain high.

Everyday Low Pricing (EDLP) focuses on maintaining a consistent set of “everyday” base prices on products, encouraging consistent consumption and hence, higher brand loyalty. It is seen as a complementary pricing approach to determine nature of price discounts and promotions over time.

2. Product

When it comes to the Product element, Hang Ten needs to consider not just the tangible clothes apparel that is being sold, but also the perceived quality and value and brand intangibles that are associated with their products. Products should offer functional benefits and also provide process and relationship benefits to best meet consumers' needs. Hence, besides providing quality clothes apparel, Hang Ten should also consider the following aspects:

Process benefits emphasizes increasing the perceived quality and value of the products by ensuring that customers have easy access to product information and broad product selection. This helps in the customers’ decision-making process.

One possible source of product information is their own website. Currently, Hang Ten Singapore’s website lacks product information and there is no other avenue to deliver the relevant product information other than through the stores themselves. Hence, Hang Ten can consider utilizing their website as a source of information through the use of catalogues.

Relationship benefits focuses on fostering loyal consumers. One method to do that is through loyalty programmes. Currently, Hang Ten offers ‘Hang Ten’ membership with every $30 spent, but they fail to publicize this. Hang Ten can consider concentrating more on the differentiated loyalty rewards and communicate them properly.

3. Place

The ‘place’ component refers to the channels of distribution where Hang Ten products are being sold. The plethora of department stores, retail stores, web-shops, etc. can be categorised into two major channel types:

Direct channels are where products are offered to end-consumers without the use of any intermediaries or third-party retailers and distributors such as company-owned stores, company website, phone or a physical sales force.

Indirect channels are where products are offered to end-users with the help of intermediaries, i.e. department stores and retailers that assist sales with functions such as bulk-breaking, customer matching and risk-bearing.

Hang Ten Singapore operates its own company-owned stores across island-wide, and maintains a presence in selected department stores (e.g. BHG). With its recurring discounts, it is evident that Hang Ten employs a strong ‘push’ strategy to move its products through the channels.

Hang Ten’s indirect channels, however, contribute little to its already strong brand awareness and emphasis should thus be placed on strengthening the brand experience instead. The ability to customise store layout and décor to strengthen its image and support marketing communications make company-owned stores a better tool to achieve this aim.

4. Promotions

The overall promotions mix consists of many complex elements that are explored below:

Advertising

Advertising can potentially bridge the gap between Hang Ten’s identity and image and build brand equity. Hang Ten needs to choose the right type of media collaterals and target the accurate avenues of advertising.

Hang ten currently employs only the use of outdoor advertising; posters in-store. Though it is highly repeated and easily noticed, exposure time in consumer eyes is far too short and the posters are forgettable with no clear message. Furthermore, the people that see the posters are most often already Hang Ten customers.

As mentioned in assignment 3, this collateral lacks description of what Hang Ten stands for, and does not tell the consumers anything. There is no product info or brand statement, and the ambiguous “We’re Hang Ten” does no better.

Hang Ten’s offering of trendy, simple, relatively cheap, substitutable and basic shirts, meanwhile, makes it a low-involvement purchase decision. Companies in this category typically take advantage of using celebrity endorsements to support their collaterals.

Other than improving the collaterals, we believe that Hang Ten should employ more visual, visible and interactive avenues. This automatically rules out the use of Radio and means that they should employ the use of print media and interactive forms of advertising. We have removed television as it is very expensive and our target market, the young adults and youths, are watching television less and less.

Sales Promotions

Sales promotions are another possible type of promotions which Hang Ten can undertake and would entail providing short-term incentives in order to encourage trial or usage of their products. There are two types of sales promotions:

- Consumer promotions

Consumer promotions consist of strategies such as samples, demonstrations, coupons and refund offers and are designed to change the choices, quantity or timing of consumers’ product purchases. Out of these, Hang Ten could consider implementing discounts, coupons and refund offers which could increase sales. However, we feel that this would end up diluting the Hang Ten brand and exacerbate current challenges, reinforcing the cheap, washed-out local brand perception consumers already hold.

- Trade promotions

Trade promotions are not relevant as Hang Ten operates their own company-owned shops and do not need to consider providing any financial incentives or discounts to retailers and distributors.

Events Marketing and Sponsorship

Public sponsorship of events or activities, art, entertainment or social causes that are relevant and in sync with the brand image can be considered. If the appropriate events are chosen, Hang Ten can successfully identify themselves with their target segment, increase brand awareness and generate positive consumer perceptions about key brand associations. This method also helps create experiences and evoke feelings amongst consumers, enhancing corporate image dimensions and ultimately, deepening their relationship with their target segment.

Although coverage may not be as wide as other promotions methods, this limitation is mitigated by the importance of our priority to convey brand identity to our target segment. Events marketing and sponsorship is high on contribution unlike sales promotion which may end up diluting the brand or projecting a negative brand identity. Even though the cost of event marketing and sponsorship would be fairly high, it is a worthwhile investment and could reap substantial benefits by boosting awareness and creating strong brand associations in the minds of target consumers.

Social Media

Hang Ten can consider Social Media as a new addition to the integrated communications mix with a choice of several outlets such as Twitter, Facebook, YouTube, Blogs and mobile phones applications.

Hang Ten can consider Social Media as a new addition to the integrated communications mix with a choice of several outlets such as Twitter, Facebook, YouTube, Blogs and mobile phones applications.The proliferation of social media platforms for marketing purposes has seen tremendous growth over the past few years, allowing companies to reach out to their target audiences and share information easily with anyone with an internet connection. Through social media marketing, Hang Ten would also be able to drive online traffic to their own website while simultaneously branding themselves with positive associations such as modern, trendy and being sociable which would help to boost their brand image amongst youth who embrace social media.

Personal Selling

This method uses face-to-face interaction with one or more prospective purchasers for sales. The personal interaction allows detailed, customized messages to be delivered to consumers and consumers can give direct feedback. A relationship is established between the marketer and the consumer, hence ensuring customer satisfaction and subsequently, brand loyalty.

Although personal selling gives emphasis on the customer and builds positive brand responses, it is too costly and lacks breadth. We do not recommend this method for Hang Ten as it is irrelevant and attempts to enter resonance stage prematurely.

Endorsement

Using well-known and admired people to promote products can attract attention to a brand and shape brand perceptions that consumers infer based on the knowledge they have about the endorser. The celebrity should be popular amongst the target group to improve awareness, image and responses for the brand. A credible endorser would induce a rich set of useful associations, judgments and feelings amongst consumers.

Hang Ten does not engage celebrity endorsement, hence missing out on a potential positive source of brand equity. If implemented, Hang Ten should strategically select well-known celebrities that are relevant to the brand. There must be a logical fit between the brand and the person, and marketing communications should use the celebrity in creative ways to highlight brand associations and facilitate their transfer.

Labels:

Assignment 4

Subscribe to:

Posts (Atom)