Through Assignment 1, we identified and established what is Hang Ten's current brand positioning and values. With this knowledge, we wish to proceed to the next step in our Brand Management Process to help measure and interpret Hang Ten's current brand performance.

In order to do so, we need to explore what are customers' mind sets, which make up an integral portion of Hang Ten's brand value chain. Therefore, research needs to be carried out on our part in order to gain greater insights.

We will begin with Qualitative research such as Free Association, Brand Personality and lastly followed by Laddering Technique. By applying these techniques in the following order, we are able to gain a deeper level of understanding of consumers' perceptions and impressions of Hang Ten.

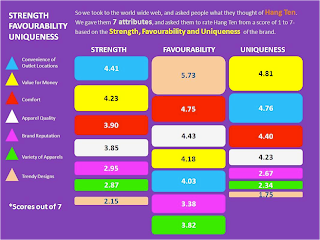

After conducting Qualitative research, we would then follow up with Quantitative research through the use of surveys which would help us verify what we have gathered earlier during our Qualitative research phase.

So stay tuned and look out for our upcoming posts detailing our findings from our research!

In order to do so, we need to explore what are customers' mind sets, which make up an integral portion of Hang Ten's brand value chain. Therefore, research needs to be carried out on our part in order to gain greater insights.

We will begin with Qualitative research such as Free Association, Brand Personality and lastly followed by Laddering Technique. By applying these techniques in the following order, we are able to gain a deeper level of understanding of consumers' perceptions and impressions of Hang Ten.

After conducting Qualitative research, we would then follow up with Quantitative research through the use of surveys which would help us verify what we have gathered earlier during our Qualitative research phase.

So stay tuned and look out for our upcoming posts detailing our findings from our research!